What Is NASDAQ100? How To Calculate It, Breif History And Companies Involved In It

The Nasdaq 100 (also known as the US Tech 100) is one of the most widely followed stock indexes in the world, containing key worldwide technology businesses and offering a snapshot of both US and international economic health. Continue reading to learn more about how the Nasdaq 100 is calculated, the firms that make up the index, and what drives the price of the Nasdaq 100.

What Is The NASDAQ100?

The Nasdaq 100 is a prominent stock market index that includes more than 100 of the world's top publicly traded non-financial companies. It is part of the Nasdaq composite index, the world's second-largest stock exchange.

The Nasdaq 100, or US tech 100, has been decided using a weighted market capitalization system since 1985, and includes companies from a variety of industries, including technology, retail, and healthcare, but excludes financial institutions such as commercial and investment banks.

The exchange-traded fund PowerShares QQQ Trust tracks the Nasdaq 100 index (QQQ).

READ ALSO: What Is Elliott Wave Theory And How To Trade Using It

How The NASDQ100 Calculated?

The Nasdaq 100 index is based on the market capitalization of its participants, with the QQQ index favoring large-cap technology firms.

The aggregate value of the index share weights of each of the index securities is multiplied by each security's last sale price and divided by an index divisor to produce the index's value. On the Nasdaq 100, no corporation can have more than a 24 percent weighting.

NASDAQ 100 Companies

Apple, Google parent firm Alphabet, and Intel are among the corporations that make up the Nasdaq index, as previously stated. Other notable enterprises include Costco Wholesale and Hasbro, a toymaker. The following companies are among the most well-capitalized on the index as of November 2019:

- Apple

- Microsoft

- Amazon

- Alphabet

- Intel

- Comcast

- Cisco

- PepsiCo

- Adobe

How Companies Get Listed On NASDAQ 100?

A company must be listed on the Nasdaq Global Select Market or Nasdaq Global Market in order to be included in the Nasdaq 100 index. In terms of securities categories, common stocks, ordinary shares, ADRs, and tracking stocks are all eligible.

Companies that trade on the Nasdaq must also have a daily average volume of 200,000 shares, publish quarterly and yearly reports, have been publicly offered for at least three months, and be free of bankruptcy proceedings.

Quarterly, companies are evaluated and added or deleted based on their market capitalization.

Brief History Of NASDQ100

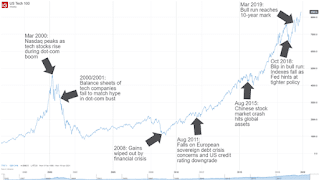

The Nasdaq has experienced substantial price changes since its founding in 1985. The base price began at $250 and has risen steadily since then, with the Nasdaq 100 reaching a high of almost 8,000 in November 2019 as tech stocks soared.

The index surged above the 5,000 level during the dot-com bubble at the turn of the twenty-first century. The index, however, became expensive as business balance sheets failed to live up to the hype as the popularity of IT stocks grew.

When the financial crisis of 2008 hit, the index, like the rest of the global stock market, took a knock, but it has been on a dramatic bull run since 2009, mirroring other indexes like the S&P 500 and the German DAX 30. On the figure below, some of the other key spots along the price trip are highlighted.

READ ALSO: What Is Elliott Wave Theory And How To Trade Using It

Factors That Affects The Price Of NASDAQ100?

The performance of the stocks that make up the Nasdaq 100 index, as well as external fundamental forces, influence the index's price.

1) The stock market's performance

Earnings reports, significant appointments, and new product launches, for example, can all affect a stock's performance and price, and thus the price of the broader index. Because of the weighting structure, events impacting the largest constituents are more likely to effect the index's price.

2) Important considerations

Broader economic factors, notably in the United States, such as interest rates, monetary policy, and general economic indicators, as well as economic performance, which affects company investment levels and consumer hunger for products, can have an impact on the index.

READ ALSO: What Is Elliott Wave Theory And How To Trade Using It

Why Must You Consider NASDAQ100?

The Nasdaq 100, as the world's most well-known technology-focused index, exposes investors to substantial price changes and extreme volatility when compared to other indices. The index also has a lot of liquidity, tight spreads, and extensive trading hours.

Nasdaq futures and options, as well as exchange-traded funds, can be used to trade the Nasdaq (ETFs). DailyFX also has more technical information on how to trade the Nasdaq, including techniques, expert tips, and trading hours.

Further Studies On NASDAQ100

Begin your Nasdaq trading trip with the most up-to-date news and analysis, and keep an eye on the Nasdaq live chart for the most up-to-date price changes. Also, don't miss our free equities forecast to stay up to date on our market analysts' newest stock and index forecasts.

Comments

Post a Comment